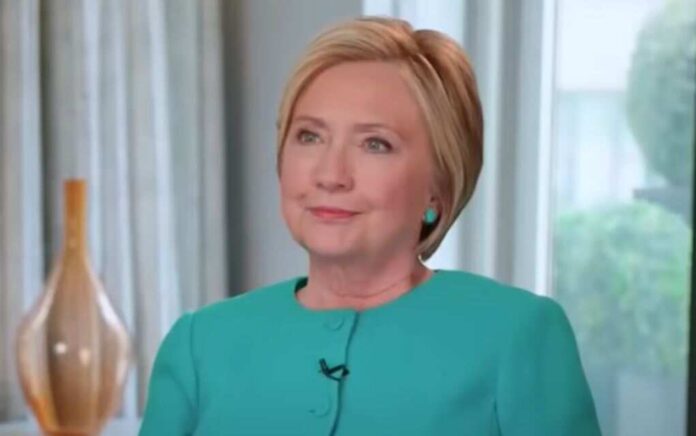

Failed Presidential candidate Hillary Clinton has been trying to lie low. Her history is haunting her.

Because a new $700 million lawsuit has Hillary Clinton scared to death.

According to reports, Hillary Clinton may have ties to a giant money fraud scheme that has already brought down dozens of people.

Late last year, Americans watched as FTX, a cryptocurrency company, was caught red-handed by the federal government in a massive money laundering and money fraud scheme that shocked millions.

Sam Bankman-Fried, the founder of the now-bankrupt company, was at the center of this whole scheme and is now facing years and years in prison depending on what his fate in court brings.

But now the disgraced company is trying to get some money back from some of those in their immediate circle.

One person FTX is going after is a former Hillary Clinton advisor.

Former Hillary Clinton aide who was reportedly lavished with payments by disgraced fallen crypto billionaire Sam Bankman-Fried is the target of FTX’s efforts to recover around $700 million.

On Thursday, the defunct bitcoin exchange filed a lawsuit against former Clinton aide Michael Kives, his company K5 Global, and Kives’ business partner Bryan Baum.

Delaware bankruptcy court documents state that in 2022, Bankman-Fried authorized the transfer of $700 million to K5 businesses and used K5’s celebrity and business connections to try to secure rescue financing for FTX in the days leading up to its bankruptcy filing in November.

The business partnership between K5 Global and FTX’s now-defunct investment arm, Alameda Research, put Kives at risk of losing hundreds of millions of dollars, despite her connections to celebrities like Warren Buffett, Arnold Schwarzenegger, Katy Perry, and Kendall Jenner.

According to the complaint, Bankman-Fried, who has been accused of fraud and money laundering allegations by the federal government, described Kives as “probably, the most connected person I’ve ever met,” and as “a one-stop shop” for political contacts and celebrity alliances.

The now-defunct crypto mogul had extensive connections to the rich and powerful, including the Clintons.

A not-guilty plea was entered by Bankman-Fried. This September, a trial will commence.

According to the complaint, Bankman-Fried ignored warnings from FTX workers that K5 was “trying to nickel and dime” or “scam” FTX, and instead kept investing to boost his own political and social standing.

According to court documents filed by receiver-controlled FTX, Bankman-Fried approved expenditures in K5 projects that benefited Kives and Baum at the expense of FTX and its consumers.

The lawsuit claims that Bankman-Fried misused $214 million in FTX funds to acquire a minority position in 818 Tequila, a liquor brand owned by Kendall Jenner’s family.

According to SEC documents referenced in the lawsuit, the value of 818 Tequila at the time of the disastrous transaction was only $2.94 million.

Including investments from SBF and his affiliates, K5 Capital manages over $1 billion and has invested in 148 firms, according to a written statement released to the media.

The Federalist Wire will update you on any developments in this ongoing story and if Hillary Clinton comes up in any lawsuit documentation.